The rise of financial technology and the integration of automation is rapidly reshaping how financial services are delivered. For customers, banks and other financial service providers are increasingly leveraging financial technology automation to make their products more accessible for customers through mobile banking, digital payments, and online trading. Behind the scenes, financial service providers are using automation to provide a better quality digital experience, streamline back office processes, enhance security, and personalize marketing at scale.

Not only has all this new technology made financial services providers more efficient and profitable, but it has helped them meet the increasing customer demand for instant access, lower costs, and more options for how to pay, trade, borrow, and bank. And the fintech automation revolution is only just beginning. Thanks to the rise of AI, exciting new use cases will help automate customer service, personalize banking services, improve fraud detection, and optimize operations.

To prepare for the next phase of fintech, it’s important to understand where fintech automation is today. Here’s what you need to know.

What is Fintech Automation?

Financial technology automation uses advanced technologies like automated testing, artificial intelligence, machine learning, and robotic process automation to optimize and streamline financial processes. It is often used to help process and manage repetitive, data-intensive, and large-volume tasks, such as processing payments, making trades, and scouring transactions for fraud. By processing data and identifying issues in real time, fintech automation allows financial service providers to significantly scale their operations without compromising accuracy, security, or compliance.

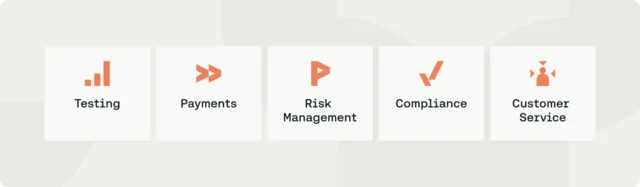

Fintech automation extends across every aspect of the financial services industry, including:

Testing: Automated testing helps uncover issues, improve quality, and ship new products and critical updates faster.

Payments: Automating payment processing reduces delays and errors, giving customers access to their money faster.

Risk management: AI helps analyze massive datasets to predict and mitigate risks like loan defaults or overexposure to volatile market sectors.

Compliance: Automated tools help financial service providers remain compliant with ever-changing global regulations, reducing the risk of fines and lawsuits.

Customer service: Chatbots allow customers to get instant help outside the branch’s normal business hours.

What Are the Benefits of Fintech Automation?

Financial technology automation helps financial services organizations remain competitive in the face of new competitors and more demanding customers. Benefits include:

Greater cost savings: Automating repetitive tasks can free up employees to focus on higher-value activities and initiatives, leading to significant cost savings. In addition, automation reduces the risk of costly errors that can result in wasted time or penalties.

Accelerated business growth: Financial technology automation makes it easier to add new products and services, allowing organizations to differentiate themselves in the eyes of their customers, adapt to market changes, and stay ahead of competitors.

Increased availability: Automation allows financial services organizations to operate 24 hours a day. In addition to processing transactions as they happen, customers can now completely manage their accounts anytime, anywhere, without the need to visit their bank branch.

Improved financial services security: Automated tools can detect and respond to potential cyberattacks, flag fraudulent transactions in real time, and ensure financial services compliance with PCI DSS, SOC 2, and GDPR.

Personalization at scale: Automation lets financial services providers customize their offerings to the needs of each individual user, increasing customer satisfaction.

What Are the Challenges of Fintech Automation?

Financial institutions may face significant hurdles as they integrate fintech automation into their operations. To overcome these challenges, leveraging a continuous quality approach powered by test automation is key:

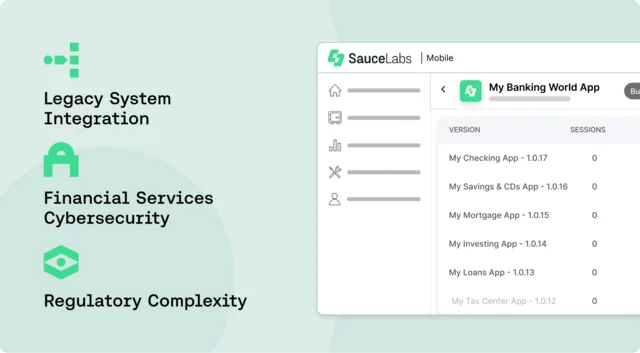

Legacy system integration: With some financial institutions still relying on decades-old legacy software, integrating modern automation technologies with outdated systems can be expensive, time-consuming, and error-prone. When combining new and old technologies, an automated QA testing solution can help catch issues that may impact operations or the user experience.

Financial services cybersecurity: Because fintech automation often relies on vast amounts of sensitive customer data, financial institutions must ensure that any fintech automation solution uses data in a way that is secure against attacks, meets regulatory requirements, and protects against accidental data exposure. An automated testing solution can help test your code against your internal security protocols while leveraging things like secure proxy tunnels and private testing devices to prevent accidental data exposure.

Regulatory complexity: Regulations like SOC 2, GDPR, and other data protection rules have specific requirements for how financial institutions can leverage customer data. A continuous quality approach lets you test how your fintech automation works so you can ensure compliance earlier in the SDLC.

What Technology is Necessary for Fintech Automation?

To ensure fintech applications work seamlessly, a test automation platform is essential. Automated testing validates the functionality, UX, performance, and security of applications leveraging fintech automation to ensure everything works as it should regardless of the device, operating system, or browser the customer uses. It also helps reduce human error by capturing more bugs earlier in the process and ensuring a consistent, reliable testing approach.

Fintech automation also relies on an ecosystem of technologies to collect and process data, create insights, and take action. For example, the cloud lets financial institutions securely store massive amounts of customer data and historical transactions.

Not only does the cloud power most fintech capabilities, but it is essential for providing the data necessary for artificial intelligence (AI) and machine learning (ML) to detect patterns, make predictions, and take action. In addition to using AI/ML, many financial institutions use robotic process automation to automate repetitive, time-consuming tasks such as data entry, reconciliation, and reporting.

How Does Automated Testing Improve Fintech Experiences?

Automated testing helps enable innovative, quality, and reliable digital experiences through a provider’s website or mobile app. With test automation, banks can offer new products that deliver personalized financial insights, customized marketing communications, or more relevant upsell and cross-sell offers. This personalized digital experience helps customers feel more supported and empowered in their customer journey, improving loyalty and growing lifetime customer value.

Automated testing tools allow developers to test earlier and continuously throughout the bank software development lifecycle so they can integrate findings and resolve bugs sooner, accelerating their ability to release new products or critical updates without compromising quality. It also allows them to simulate real-world scenarios like network throttling or high transaction volumes to identify potential issues before they impact users. When used in conjunction with manual testing, test automation can maximize team productivity, time savings, and costs.

The Future of Fintech Automation

While the financial services industry has already made great strides in incorporating automation, it is still early days in terms of both adoption and technology maturity. As AI continues to advance and systems become more integrated, more and more decision-making and management will take place autonomously.

In the meantime, expect the customer experience to become primarily if not completely digital. Even today, few customers want to go to a bank branch to speak to a teller or loan officer. Soon, the customer relationship will be nurtured entirely through interactions with a mobile app, website, or through digital marketing communications.

As fintech solutions grow more complex and come to dominate the user experience, the need for advanced test automation will only increase. An automated test platform will become essential for ensuring reliability, functionality, and security while streamlining fintech application development and deployment of new products, features, and updates.

Start Automating Your Financial Services

Test automation is something financial services organizations can easily incorporate and leverage right now. Sauce Labs gives financial services organizations the enterprise test automation platform required to unlock:

Increased scalability: Our cloud-based platform scales effortlessly, ensuring comprehensive coverage with access to thousands of real devices, plus browsers and OSes, while also automating the entire process of UI and visual testing.

Greater speed: With test automation, financial firms can run thousands of tests simultaneously, significantly speeding up fintech development. Our scalable infrastructure, combined with AI-driven insights, enables teams to identify issues early, ensuring a quality digital experience for customers.

Improved compliance: Sauce Labs offers a secure, compliant platform that supports financial services companies in meeting regulatory demands. Our platform is SOC 2 Type II, SOC 3, ISO 27001, and ISO 27701 certified, and compliant with regulations. Sauce Labs also enables financial institutions to securely test their apps in private environments using proxy tunnels and secure data centers.

For tips on how to use test automation to deliver a quality mobile experience, check out our checklist: A Comprehensive Checklist for Optimizing Your Mobile Banking App.